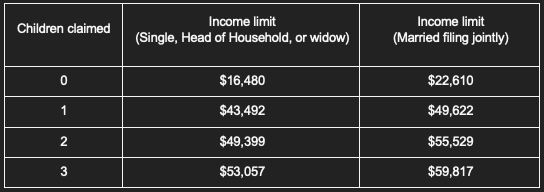

The child tax credit generally applies to dependent children under 17 although there are some. The value of the child tax credit and additional tax credit decreases if the parent or guardians gross..

If you have a general enquiry To find out if you qualify for tax credits You can also use Relay UK if you cannot hear or speak on the phone. Universal Credit How and when your benefits are paid Tax credits if you leave or move to the UK Help if you have a disabled child Tax credits. Reporting serious misconduct by HMRC staff Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax. The main telephone number is the Tax Credit Helpline You can also use NGT text relay if you cannot hear or speak on the phone. There is more information about the HMRC App on the GOVUK website The main telephone number is the tax credit helpline..

WASHINGTON The Internal Revenue Service and the Treasury Department. You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all. This website provides information about the Child Tax Credit and the monthly advance payments made from July. 250-300 a Month Per Child Starting today working families will receive monthly payments of 250 for..

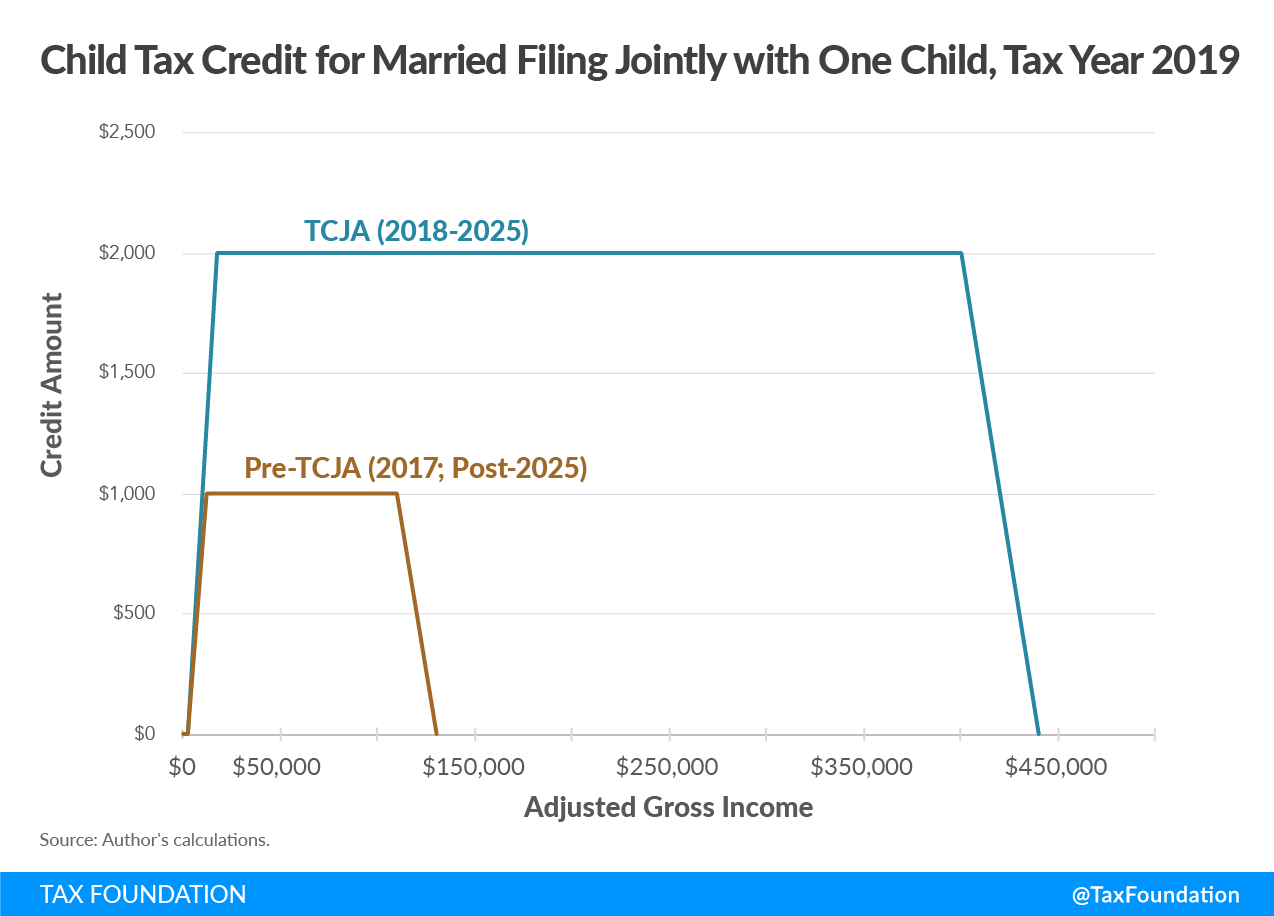

You qualify for the full amount of the 2023 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual. Be claimed as a dependent on your tax return A portion of the Child Tax Credit is refundable for 2023 This portion is called the Additional Child. Introduction Use Schedule 8812 Form 1040 to figure your child tax credit CTC credit for other dependents ODC and additional child tax credit ACTC. For the 2023 tax year taxpayers may be eligible for a credit of up to 2000 and 1600 of that may be refundable The child tax credit is a tax. This legislation which gradually increases the credit would apply to the 2023 child tax credit and raise the refundable amount of the..

Comments